One calendar week ago, I discussed the plan of the CME group to allow trading of Bitcoin futures. See a a press release, in addition to its review inward Business Insider, underlying reference rates (BRR real-time in addition to BRTI daily rate).

Last night, Business Insider brought us

[We only got] a glimpse of how bitcoin futures volition workThere are many details over there. Let me human face at them first.

At this moment, when I write this sentence, the Bitcoin toll is $7,400 so I volition refer to it as the electrical current price. We larn a lot of details nearly the trading.

In particular,

- there is likely no leverage, the Bitcoin is sufficiently volatile fifty-fifty without it (I suppose that the brusk positions must soundless survive insured past times some margin telephone band when, assuming no reserve funds, the Bitcoin toll doubles or something similar that)

- the expiration moments when the futures are settled inward cash volition survive on some days (probably all days from Mon to Friday, five a week), 4 p.m. London fourth dimension – the small town prices are likely just the BRTI daily reference charge per unit of measurement that already exists

- one contract is five Bitcoins ($37,000 at electrical current price); the article implicitly suggested you lot can't purchase whatever fractions but I am non quite sure

- the maximum that i entity may concur is plus minus 1,000 contracts i.e. 5,000 futurity Bitcoins ($37 i chiliad k at electrical current price) so that no i gets the monopoly to individually corner the market (manipulate toll inward a way that only the biggest fish tin hand the axe use) – well, I suppose that traders from 10 large banks who speak to each other mightiness corner it, anyway

- the toll where you lot buy/sell futures must survive a multiple of $5 per Bitcoin (i.e. $25 per contract), so the toll may alter from $7,400 to $7,395 in addition to $7,390 etc., amongst a downtick every five minutes, for illustration LOL

- trading is from five p.m. of the previous twenty-four hours to 4 p.m. Central Time – 23 hours a day, five days a week

Current BTC price

As I convey repeatedly mentioned, the Bitcoin toll dynamics is the ultimate random walk. Various people may follow some strategies – they may endeavor to extrapolate the recent momentum, or – on the opposite – bet that recent swings volition acquire reverted. They convey diverse fourth dimension scales etc. And the final result is a random walk or Brownian motion, a Markov procedure where the toll is de facto described as\[

{\rm Price}_{\rm Bitcoin} = P_0\cdot \exp [ W(t) ]

\] where \(W(t)\) is a random walk i.e. \(\langle W(t)^2 \rangle = t/t_0\). The typical departure of the logarithm of the toll behaves similar \(\sqrt{t}\) divided past times the foursquare root of a fourth dimension scale \(t_0\) – that's some proportionality constant.

For years, there's been some additional "clear momentum upwards" but that volition likely survive over, as I volition speak over momentarily.

To convey some thought how to calculate \(t_0\), it may survive fun to dissever the random walk to private transactions. These days, at that spot are roughly 300,000 transactions a twenty-four hours in addition to the daily book is $2.5 billion i.e. 340,000 Bitcoins. Also some 300,000. So it's an fantabulous approximation to country that the average Bitcoin transaction is nearly BTC 1. Note that the median transaction is only some BTC 0.1, i monastic enjoin of magnitude smaller – due to the large "wealth inequality". It's the rich folks who primarily create upward one's bespeak heed nearly the average.

It may survive helpful to eliminate transactions that are much smaller than the average one. I guess that nosotros could country that at that spot are only 100,000 "not tiny" transactions in addition to their average is BTC three per transaction. H5N1 bully model to visualize a random walk. If each transaction moves the Bitcoin toll past times \(\Delta P\) inward a random direction, 100,000 such transactions displace it past times \(\sqrt{100,000}\sim 300\) times \(\Delta P\). Because the daily toll changes are of monastic enjoin 5% inward average, i transaction changes the toll past times some 5/300=0.017%. That's $1.2 at electrical current price.

OK, so my model for the natural trading is that a bunch of random traders purchase in addition to sell 100,000 times BTC three every day. Every fourth dimension they practise it, the toll moves past times $1.2 inward a random management (away from some pose out comparable to $7,400 now). Most of them cancel, only roughly "300" transactions don't cancel good – the foursquare root of the pose out of transactions.

That's a funny motion painting because it suggests that the uncancelled momentum builder only comes from some 300 transactions per BTC three i.e. from the traders involving some BTC 1,000 ($7.4 million) a day. That's 1/5 of the maximum bound per entity that tin hand the axe merchandise the Bitcoin futures. So at that spot is a lot of potential to insert non-randomness through the futures traders.

What volition survive the implications of the trading on the Bitcoin price?

First, endeavor to assume that the futures traders assume that inward the side past times side month, the Bitcoin toll volition proceed skyrocketing – the tabular array at the really bottom shows that trading volition survive upward to the final Fri of a month, 4 p.m. London time, in addition to some 4 side past times side such Fridays volition survive available at each moment. If the marketplace seat thought so, the (end-of-)December futures could survive traded at $15,000 per Bitcoin. But the large traders of actual Bitcoin could almost lock a turn a profit – to survive realized on the expiration date, past times closing both existent Bitcoin in addition to futures positions – past times shorting the futurity in addition to buying the existent Bitcoin to a greater extent than cheaply at the same moment! In effect, they would purchase a inexpensive existent Bitcoin in addition to sell a negative Bitcoin at a higher price, which agency profit.

This arbitrage chance volition forthwith force the difference to null or some modest technical values. The futures shouldn't survive traded good inward a higher house the electrical current Bitcoin price, I think. The futures' toll should ever betoken that the Bitcoin's futurity is non bright, to pose it mildly.

Note that the opposite machinery doesn't genuinely piece of work because you lot can't brusk the existent Bitcoin effectively. For this reason, it's to a greater extent than ofttimes than non assumed that the Bitcoin futures volition betoken the futurity toll below the electrical current price, or below the electrical current toll plus some technical, profit-dictated constant which includes some fees in addition to other expenses. The rational existent Bitcoin traders volition survive able to human face at the futures, run into that the futurity Bitcoin toll doesn't human face genuinely higher than today, so it's ameliorate to sell.

OK, at what levels should the large fish purchase or sell the futures?

First, before nosotros speak over the trend, it seems obvious that the futures trading should trammel whatever volatility. Because almost all the volatility is rationally unjustifiable, the trading of the futures may kill the volatility completely. The Bitcoin is an illustration of the perfect ultimate bubble but it should also survive an illustration of an "asset" where the dissonance may survive suppressed completely. There's a difference from gilded or other commodities. The traders of gilded futures must genuinely brand an guess at what gilded toll the provide in addition to need are sustainable. If the gilded toll is likewise low, the organization runs out of gold. But the Bitcoin is every bit sustainable at any price. The Bitcoin toll lives exclusively inward the people's heads.

So I remember it makes feel for the traders to assume that the "actual" Bitcoin toll is an extremely polish share of time. They should purchase the futurity Bitcoin whenever its toll gets beneath this polish curve, in addition to they should sell it whenever it gets inward a higher house it. They should only pass some of their bound on positions for these purchases – to convey a reasonable probability that they won't striking the bound of 1,000 contracts before the expiration day.

At the beginning, i could hold back for the residue of the marketplace seat to force the prices somewhere. But perhaps it's non a expert thought to hold back because the existent profits start correct away. I don't know what to do. Everyone who trades the futures likely realizes that the other traders are rather intelligent – each of them may afford $37,000 for this fishy position. ;-)

I don't know what to practise amongst the initial "one time" kicks into the existent Bitcoin toll in addition to the futures price. However, I notice it totally sensible that only hours or days later, the Bitcoin traders could endeavor to target some decreasing exponential share for the price:\[

{\rm Price}_{\rm Bitcoin} (t) = {\rm Price}_{\rm Bitcoin} (0) \cdot \exp(-t/t_1)

\] After the minute \(t=0\) where this behaviour begins, it may survive assumed that the toll of the Bitcoin is decreasing exponentially amongst the fourth dimension scale \(t_1\). One tries to accommodate \(t_1\) at every moment. And i tries to purchase brusk or long positions according to the deviations from this function, but guess the charge per unit of measurement at which you're buying so that you lot don't run out of your wiggle room – the bound of 1,000 contracts – before the expiration moment. Because of the bound of 1,000 contracts per entity, no unmarried entity volition survive strong plenty to eliminate the fluctuations away from a polish bend completely. But lots of entities trading the futures genuinely might be – they mightiness collectively bear as the perfect removers of all the noise.

I await farther decrease of transactions inward the existent Bitcoin, in addition to fifty-fifty higher fees

It's pretty funny but the futurity Bitcoin toll may genuinely survive really some a seemingly predictable polish share of time, such as the decreasing exponential above. This volition convey consequences for the existent Bitcoin traders, too. Lots of them volition start to believe it – for expert reasons. The marketplace seat mightiness survive trained to sustain i polish share of fourth dimension or another. This style to co-operate on the "apparent hypothesis nearly the futurity price" may also survive described as a self-fulfilling prophesy. I believe that since the Czech National Bank interventions against the Czech currency that began just 4 years ago, this "trained market" has shown itself inward numerous stages. Also, it is pretty clear that these days, the EURCZK volatility is some 1/2 of what it was 5-10 years agone (e.g. inward 2009 when the EURCZK changed past times to a greater extent than than 0.5 almost every month), because of the lots of crowns that were printed during the interventions in addition to are held past times foreigners.

At whatever rate, I notice it obvious that after a sufficient pose out of the Bitcoin futures be – in addition to I assume that some of these traders merchandise both in addition to work the arbitrage opportunities – the Bitcoin toll loses much of its daily volatility. That's what the futures to a greater extent than ofttimes than non do. But in i lawsuit the existent Bitcoin toll becomes much to a greater extent than stable, at that spot volition survive many fewer reasons to purchase or sell correct now. The room for daily traders of the existent Bitcoin volition shrink.

Lots of people in addition to bots may only follow a funny strategy – endeavor to hold back when the Bitcoin toll drops past times $30, buy, in addition to so it goes upward $30, sell, in addition to you lot brand a turn a profit that beats the fees. (Obviously, inward the long run, you lot don't earn anything on it because sometimes the toll refuses to render where you lot desire it to return, so you lot may either survive caught amongst Bitcoins during a collapse, or without Bitcoins during a growth you lot missed.) But when it volition survive harder for the Bitcoin to displace past times $30 upward or down, the frequency of these transactions volition diminish.

In the previous weblog post, I discussed the high Bitcoin fees – i transaction costs $10 inward average now. I mentioned that the fees went upward because the Bitcoin toll went upward hugely but the daily pose out of transactions only increased some 20% from a twelvemonth ago. So if the pose out of transactions decreases, because the lower volatility makes it less interesting in addition to exciting to purchase or sell – in addition to it's harder to vanquish the fees (which is a description of the alter that is independent of emotions) – it volition hateful that the average transaction fee volition increment further.

If in addition to when the futures are sufficiently numerous to trim the volatility of the Bitcoin toll to 1/5 of the acquaint value, the average transaction fee may really good locomote from $10 to $50 as the pose out of existent Bitcoin transactions drops from 300,000 to 60,000. This increment of the transaction fees would discourage transactions further. This style of the transaction fees in addition to the wearisome development of the Bitcoin toll volition likely Pb some of the smaller Bitcoin holders to sell everything – millions of modest Bitcoin users couldn't afford a unmarried fee, millions of others could only afford to pay a fee few times, in addition to so on.

BTCUSD inward recent seven days

As the pose out of people who are meaningful members of the Bitcoin network drops, so volition the thought that it's the money of the future, in addition to fifty-fifty the larger investors realize that the game is over in addition to it is meaningless to concur it. The wise brusk sellers should soundless endeavor to purchase the dips in addition to sell the upticks from a polish function, fifty-fifty if that share began to driblet rather dramatically.

Let me country that the allowed daily driblet (or rise) of the futures is 20%. It agency to multiply the toll past times 0.8 a day. 0.8 to the 5th powerfulness is 0.32768 i.e. the autumn past times 2/3 a week, or past times some 99% a month. It's plausible that the Bitcoin marketplace seat understands the fate of this "asset" before in addition to the Bitcoin toll volition systematically autumn past times to a greater extent than than 20% a day. In that case, however, I believe that the futures won't genuinely affair much.

While the futures opened upward the trading to lots of large novel investors in addition to at that spot are opportunities to brand the toll swings genuinely volatile in addition to unpredictable, I am convinced that – piece at that spot volition survive some events I can't predict – the overall appearance of the effect of the futures volition clearly survive "a huge reduction of the volatility". This fact past times itself volition repel the existent Bitcoin trading in addition to bets, trim the pose out of transactions, increment the fees, in addition to gradually encourage everyone to sell the Bitcoin.

Even though I can't genuinely exclude the rising of the Bitcoin toll inward a higher house $10,000 or something similar that – when millions of teenagers bet their parents' houses non only on the existent Bitcoin but also the long futures positions – I notice it unavoidable that if the trading of the futures begins at all, the path towards the incredibly shrinking Bitcoin volition locomote obvious within a calendar month or at most months, if non days. The potential for large gains inward a calendar month or ii should evaporate because the futures volition betoken a similar toll as the electrical current toll or lower (otherwise at that spot is the arbitrage chance I mentioned); the daily variations in addition to the related gambling volition also shrink (so the traders who basically practise daily gambling volition also fade away); in addition to the fees volition locomote upward as the pose out of existent Bitcoin transactions decreases, so lots of the normal Bitcoin users volition disappear because they won't survive able to afford the fees.

It seems somewhat plausible to me that those who decided to create the CME Bitcoin futures marketplace seat – or who are genuinely behind the projection – realize these things in addition to they are doing it deliberately inward monastic enjoin to deflate the Bitcoin bubble which some of them may survive annoyed past times (like me) or which others may fifty-fifty experience threatened by. It's also possible that the banks were intensely buying BTC inward recent weeks – thus the growth – in addition to they volition survive selling existent Bitcoins along amongst brusk positions to brand the turn a profit in i lawsuit the futures are available.

There are lots of unknowns that may invalidate the reasoning above. In particular, it seems totally plausible to me that most of the people – in addition to fifty-fifty when weighted past times their wealth – who merchandise the existent Bitcoin are so financially illiterate (or obedient to the cult) that they won't empathize or they won't work the arbitrage chance I mentioned, in addition to they volition purchase the long futures to drive their toll good inward a higher house the electrical current Bitcoin price, although it's clearly ameliorate to purchase the existent Bitcoin in addition to hold back for the expiration appointment instead. When BTC split to BTC in addition to BCH, their full toll – wealth of the quondam BTC holder – jumped discontinuously. Such irrational discrepancies practise occur inward the footing of the Bitcoin because a large fraction of the traders genuinely don't empathize basic identities that concur inward efficient markets, they don't empathize key tricks to brand profit. But I tend to remember that when others, rational participants are allowed to acquire into – both brusk in addition to long futurity positions, plus the Bitcoin itself – they volition exploit the opportunities that the Bitcoin fans neglect to exploit.

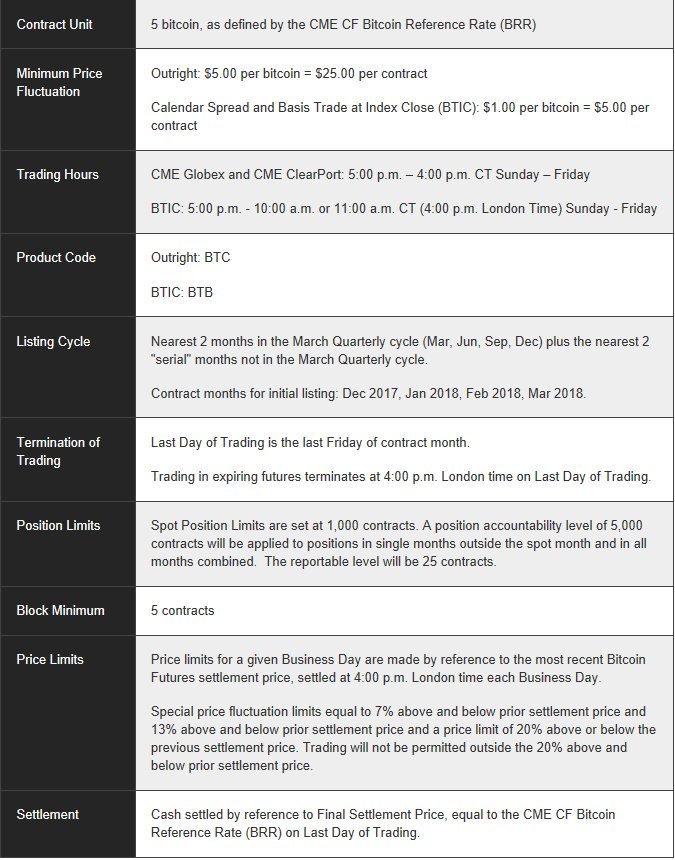

Bonus: a tabular array nearly the CME contracts

One must realize that on locomote past times of the random walk above, at that spot be "legitimate" reasons for toll changes, e.g. expected bans in addition to other regulatory stories – negative in addition to positive – as good as the worries nearly the potentially devastating SegWit2x fork side past times side week, the subsequent exodus from BTC of those traders who remember that the fork is a "dividend for free" they went to pick, in addition to so on.

Daily movements

This is an update. The Bitcoin went from $7,100 to some $7,800, a novel record, in addition to and so dorsum to $7,100 or so, at Bittrex.com. The roughshod 1-hour 10% driblet inward the eve was patently because the 2x fork was called off past times an e-mail past times utterly sensible proponents who realize that the BTC straitjacket is already likewise tight. This should survive expert tidings for BTC – a huge existential threat has disappeared – but as I could already convey predicted, for the clueless millennial "traders", it's bad tidings because they remember that they won't acquire their "free dividend". ;-)

No comments:

Post a Comment