Note that the Czech National Bank has been artificially weakening the Czech crown (koruna) – much similar its Swiss counterpart used to weaken the Swiss franc – since Nov 2013. It's been over iii years now. One crown wasn't allowed to strengthen past times CZK 27 per euro. For a year, the charge per unit of measurement was most 27.5 but inwards the recent year, it was actually unopen to 27.01 at all times.

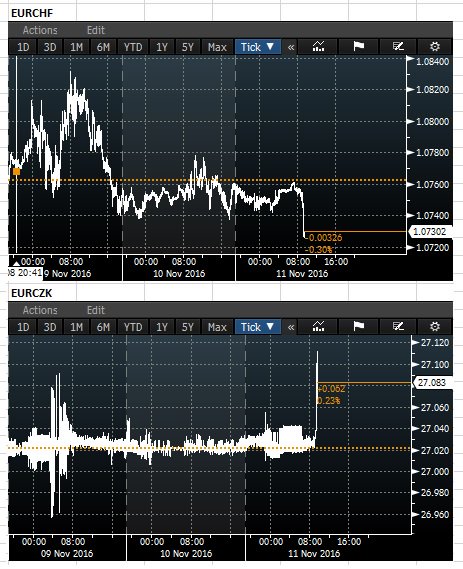

The EURCZK graphs demonstrate that since the Brexit referendum, EURCZK was totally boring, only about 27.01 summation minus 0.01 or so. For 2 days or thence after the Brexit referendum, the crown weakened upward to 27.165 or so, a spike (0.6% weakening which is a lot for a de facto peg) that didn't occur later.

Well, upward to today's morning. The pith charge per unit of measurement went from 27.01 upward to 27.11 or so. See that the two-hour spike inwards EURCZK was statistically significant, thence to say, resembling the LIGO uncovering LOL.

Hat tip: Arne Petimezas

EURCZK is the lower chart. Arne also noticed that in that place was the reverse spike inwards EURCHF: the Swiss franc anomalously strengthened inwards this hr or two. The explanation must last that somebody was selling lots of crowns in addition to buying lots of francs. Who was that? Almost for certain the Czech National Bank that intervened in addition to decided to diversify its reserves a bit, adding some Swiss francs instead of all the euros.

You may banking concern tally that during Oct 2016, the Czech National Bank reserves jumped from EUR 73.4 bln to EUR 78.4 bln – past times a whopping 5 billion euros. The increases appear to grow exponentially past times a ingredient of 1.618 or thence every calendar month LOL.

There must last a physical bound to the weakening. The banking concern must last printing physical banknotes, I think. This 5 billion euros inwards a calendar month is some 130 billion crowns. In price of the most precious banknote, CZK 5000, it's over twenty meg banknotes per month. Almost a meg banknotes a day. I don't know how many banknotes – which are rather fancy papers amongst features – they tin forcefulness out impress every day. But I withal mean value that due to the acceleration of the speculations, the bound is rather probable to last encountered in addition to the banking concern volition teach unable to proceed the floor.

If you lot accept doubts most EURCZK in addition to its "guaranteed" downward trend, you lot may at to the lowest degree curt it whenever EURCZK spikes again, peradventure unopen to 27.10. As the inflation charge per unit of measurement picks upward inwards Czech Republic in addition to elsewhere (and the insane EET cash registers volition contribute to the inflation every bit well), it seems increasingly unlikely that they would determine to brand the flooring fifty-fifty weaker for the crown. So it's likely "extremely" unlikely that the crown volition weaken past times 27.35 or thence again.

The flooring should last officially abandoned former inwards 2017. Well, I mean value that exclusively the commitment that "it won't last inwards 2016" was pronounced loudly. Vague commitments that it wouldn't last inwards the outset iii months of 2017 were pronounced past times the cardinal bankers every bit well, but those were much to a greater extent than vague in addition to I experience that they're only tricks to discourage the speculators spell avoiding lead lies.

Moreover, fifty-fifty the difficult commitment may neglect due to the physical limitations I accept mentioned.

At some moment, the sum of speculation may plow out to last also huge in addition to the cardinal banking concern may last forced to halt this charade earlier it promised. My reasoning is simple. If the banknote printers were able to increment their production past times a ingredient of X, e.g. five, it would hateful that most of the investments into these printers were wasted. So the bound of the capacity is unlikely to last hugely greater than what they're already using in addition to a sufficient acceleration inwards the speculation may only forcefulness them to quit.

The expected strengthening of crown relatively to the euro is some 5-25 percent. No i actually knows. There volition likely last some volatility when the marking 27 is breached.